Ibank Vs Quicken For Mac

With Mac OS X 10.7 Lion now shipping, I am in process of upgrading. But I am one of those poor unfortunate souls that use Quicken for Mac. It came with some of my Mac's way back so I started using it. I'm not particularly fond of it, but it generally worked, Inertia speaks.

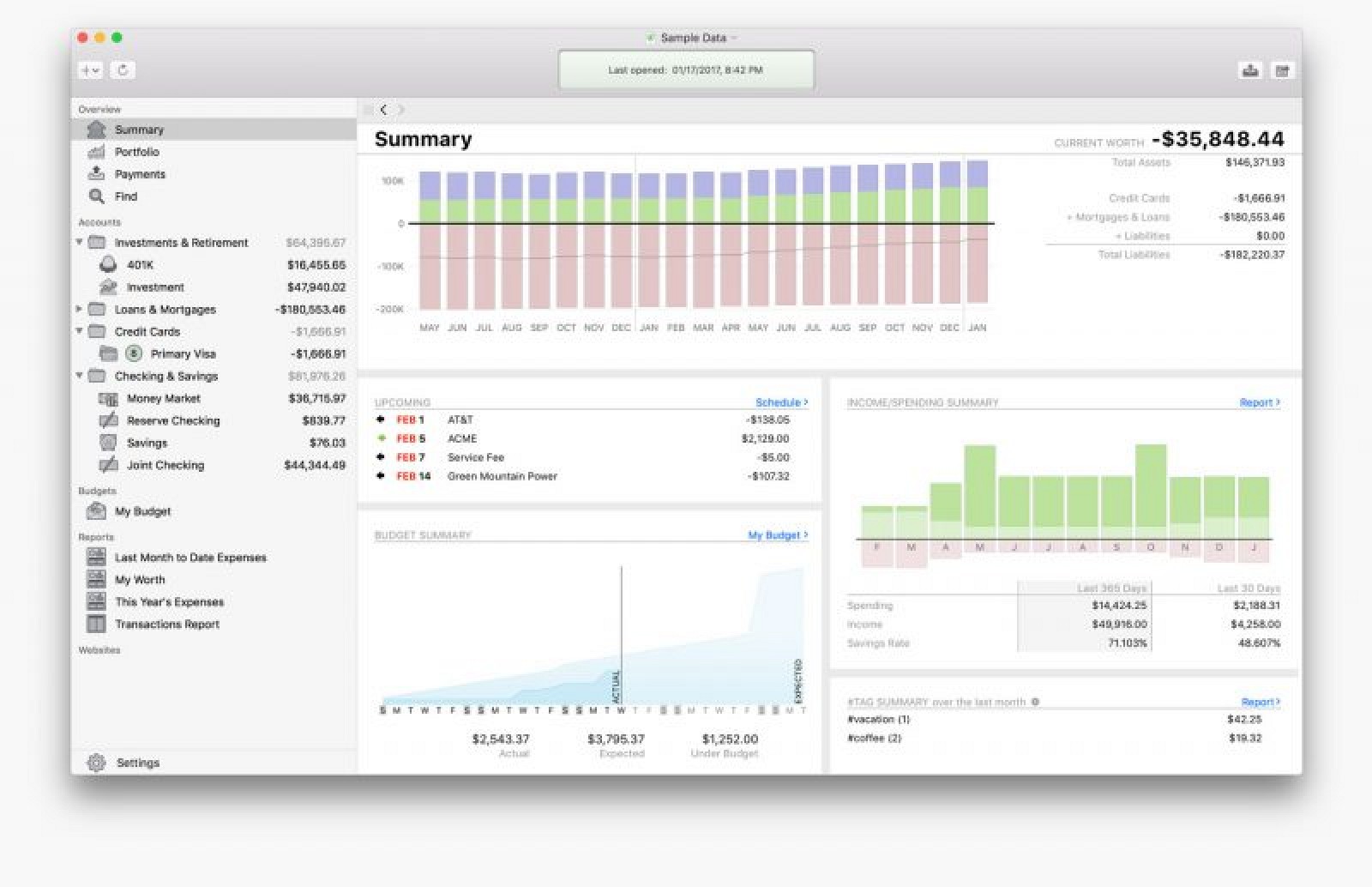

Banktivity (iBank 5): Best Personal Finance Software for Mac iBank was founded in 2003, with the vision of helping individuals–especially small business owners–control their finances virtually, enabling them to succeed in the highly competitive entrepreneurial world of today. It seems to be the most mac friendly of the lot.  If you can download electronic statements these can be imported. IBank will except data in most formats. Question: Q: ibank/moneydance or quicken essentials More Less. Apple Footer. This site contains user submitted content, comments and opinions and is for informational purposes only.

If you can download electronic statements these can be imported. IBank will except data in most formats. Question: Q: ibank/moneydance or quicken essentials More Less. Apple Footer. This site contains user submitted content, comments and opinions and is for informational purposes only.

But as many of you know, Intuit failed to update Quicken and has relied on Rosetta which no longer ships on Lion. A large part of my Quicken usage is to track investments so Quicken Financial Life or Essentials is not an option for me. I am also still too paranoid/resistant to online services that track everything in one place, so I don't use those. In a nutshell, I have started looking for a replacement. My requirements mostly center around finance and investment tracking. I don't really need budget planning features. I ruled out Moneydance which I have read many good things about, mostly because I generally dislike using cross-platform Java UIs.

Also, I am concerned about how hard it will be to run Java on Mac in the future. After reading a lot of reviews and opinions, it seemed that only iBank 4 met my criteria. IBank 4 seems to have hit critical mass and seems to be the most popular of the Mac personal finance software programs. I just downloaded the free trial, and it seems to meet most of my requirements. But there was one feature that really irked me. Their Direct Connect feature which automatically contacts your financial institution and syncs account data does not work with The Vanguard Group.

According to iBank's forums (apparently, there are already users already complaining about this), this is because Vanguard uses OFX 2 (an open standard for financial data exchange) instead of an older OFX 1.1. IBank has not updated their software to support OFX 2 and they seem resistant to the idea, with suggestions that it is not worth their time since Vanguard is the only institution using it. Never mind the fact that Vanguard is now the largest mutual fund company. Also, dragging their feet on supporting a newer version of an open standard strikes me as reminiscent of Intuit not updating Quicken to get off of Rosettathis is the mentality I am trying to flee.

Other than the Vanguard issue, the iBank seemed really nice. The user interface is polished, my data imported without serious incident, and there seemed to be a lot of interesting features. I also really liked their forums because I was able to find a lot of information about the specifics of the product, from what it can and can't do, to how to actually do stuff.